Multiverse, IonQ team up to give finance apps a quantum boost

If you want an early glimpse at how quantum computing will be used in real-world business applications, the financial sector is the place to look. Finance apps were a big topic of discussion at the recent IQT Fall event, and now two of quantum’s fast-rising upstarts are partnering to enable these applications.

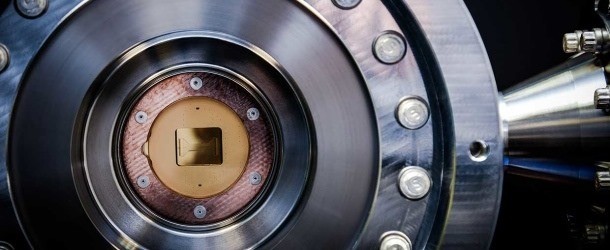

Multiverse Computing, a recently-funded Spanish start-up that is among the first to focus on quantum finance apps, announced Thursday a partnership with IonQ, enabler of trapped-ion quantum computing.

In an exclusive arrangement, the IonQ Quantum Cloud platform hardware will serve as the “sole quantum computing backend” to power Singularity, which is Multiverse’s computing financial solution, according to Peter Chapman, president and CEO of IonQ, who spoke with IQT News via email.

Using this integrated system, the partners said financial institutions can speedily and accurately model real-life financial problems, such as Fair Price calculations, portfolio creation and optimization, ETF replication, risk valuation, and many other simulations. Singularity already allows analysts and other users to model problems directly within spreadsheets and other familiar tools, but by integrating with IonQ they will now be able to use today’s quantum computing hardware without having to write any code or pursue a PhD in quantum physics.

Chapman said finance is becoming an important technology showcase for IonQ. “Finance is emerging as one of the first sectors poised to reap the benefits of quantum computing and most large firms are looking into the technology,” he noted. “Financial firms have always been at the leading edge of using new technology to gain a competitive advantage, as performance improvements of even a few percentage points can dramatically shift the competitive landscape. Several quantum computing applications, such as quantum machine learning, are poised to have dramatic business impact in the sector in the coming years as hardware progresses.”

IonQ also has worked directly with come financial institutions. For example, using IonQ hardware, “Fidelity demonstrated a quantum machine learning algorithm that, when compared to a classical machine learning model with comparable parameters, was more predictive and converged (trained) in fewer iterations. In this case, it was notably better at predicting certain outlier events in the statistics, so-called ‘Black Swan’ events that are notoriously hard to anticipate.” (Sonika Johri, senior quantum applications research scientist at IonQ, spoke in detail about the Fidelity project in a presentation at IQT Fall.)

He said other firms that have publicly expressed interest in quantum finance applications include Goldman Sachs, JP Morgan Chase, HSBC, Citi, Wells Fargo, Barclays and more.